Plenary: Strengthening resilience to climate change through financial inclusion

- Tim MCDONNELL, Journalist and National Geographic Explorer

- Natalia REALPE CARRILLO, HEDERA

- Sarfraz SHAH, APA Insurance Ltd. (Kenya)

- Rolando VICTORIA, ASKI Group of Companies, Inc. (Philippines)

- Pedro Emilio MARCHETTI, Financiera Fondo de Desarrollo Local (FDL) (Nicaragua)

KEYNOTE SPEECH

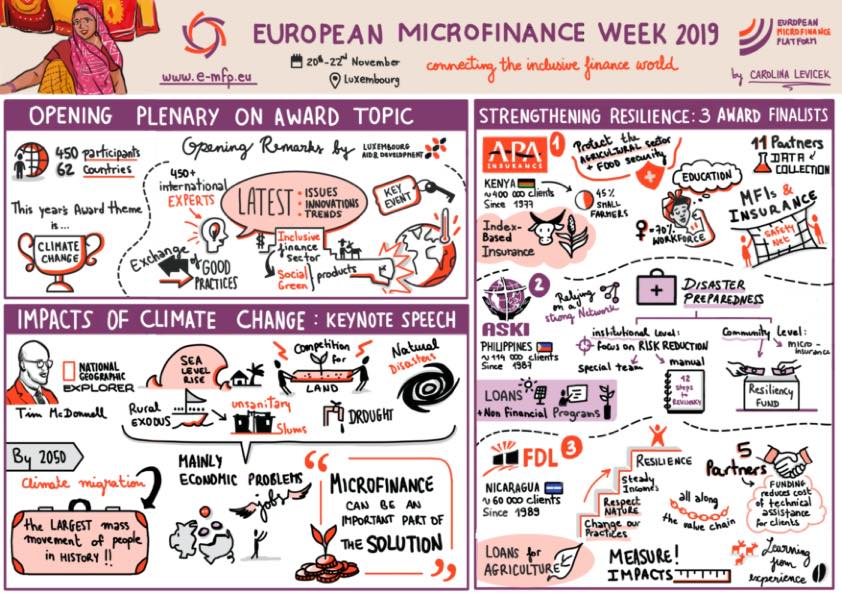

Tim MCDONNELL shared several stories of communities whose lives have been affected by climate change. His stories showed that large numbers of people are displaced by climate change. They must flee their village or region, because their houses are destroyed by floods, soil salination makes their land unsuitable for farming or violent conflicts arise from increased competition for natural resources.

According to McDonnell, at least 20 million people are displaced by extreme weather events every year. That number does not include those displaced by slow-moving changes like sea level rise and desertification. By mid-century, the total number of climate-displaced people could grow to anywhere from 200 million to one billion. This is likely to be the largest mass movement of people in history.

Climate-induced migration is often expensive or dangerous and many people lose their livelihoods, families or even their lives. Some move to new settlements without sanitation or access to education services. Others fight for survival by taking on underpaid arduous jobs.

In the case of Guatemala, drought is a major driver of migration and many migrants head for the USA. NGOs had set up a programme to provide monthly cash payments to people in Guatemala who were struck by natural disasters. Unfortunately, these NGOs were forced to stop these cash transfers after a change in the foreign aid regime by the USA.

McDonnell stated we are far past the point of stopping climate change. We must now find ways to support climate-displaced people with adapting to climate change. Climate-displaced people still lack any legal protection under international law. Governments, financial institutions, scientists, civil society, businesses, and the media all have roles to play in promoting security, equality and opportunities.

PLENARY DISCUSSION

Natalia REALPE CARRILLO introduced the three finalists for the 2019 European Microfinance Award, focused on strengthening resilience to climate change. The first nominee, APA, is an insurance company in Kenya providing Index-Based Livestock Insurance and Area Yield Index Insurance to smallholder and subsistence farmers. The second nominee, ASKI, is a microfinance institution in the Philippines that provides agriculture and guarantee funds for individuals and MFIs, green loans for access to energy, and rehabilitation loans & resiliency funds for disaster victims. The third nominee, FDL, is providing loans for agriculture, livestock, water conservation and harvesting, irrigation systems, and productive diversification, coupled with technical assistance for climate change adaptation, in Nicaragua.

Realpe Carrillo requested all conference attendees to be conscious of their responsibility as proponents of financial inclusion and stressed the need to find solutions to climate change together. Before giving the floor to the award nominees, she urged attendees to use the networking opportunities at EMW to create new partnerships for dealing with the crisis and to become protagonists of climate action.

Sarfraz SHAH of APA was the first to present his institution’s work. He explained the three reasons why his financial institution started working on climate change solutions. First, in 2011, Kenya was hit by a bad drought that affected many people, since Kenya derives 61% of its GDP from agriculture, and 75% of the people working in the agricultural sector are small farmers. Second, being an insurance company, APA could provide some measure of protection to the economy. And, last but not least, many people in the country required food security.

Rolando VICTORIA of ASKI explained that climate change compelled his company to innovate. The Philippines is frequently struck by natural disasters such as volcano eruptions and typhoons. These disasters destroy properties and businesses. In response to the financial needs of victims, ASKI started providing micro loans and microinsurance to support the poor.

Pedro Emilio MARCHETTI of FDL stated that we have to adjust to climate change by strengthening the resilience of the poor and that the microfinance sector can work in harmony with the environment. Microfinance institutions must promote environmentally friendly practices amongst their clients and discourage damaging practices. This focus on the environment is in the interest of the poor, because it will result in steady income. As microfinance institutions have large numbers of clients, changing their practices can have a huge impact globally. It is even possible to regenerate ecosystems by putting carbon back into the soil.

Realpe Carrillo guided the discussion by asking the finalists about their motivations, actions, and the partnerships developed to tackle climate change. Regarding the products developed by financial institutions in response to climate change, Shah explained that APA developed two financial products around a weather index. Along with index-based weather insurance, APA developed livestock insurance. For this pre-disaster insurance product, APA uses satellite data to enable cattle farmers to effectively manage their pasture and move their cattle to suitable locations before a drought strikes. This product is particularly valuable for areas with little rainfall such as Northern Kenya.

Victoria emphasised the importance of developing financial products that fit the needs of clients. ASKI developed a value chain programme to organise farmers into cooperatives and provide technical training and access to renewable energy. The programme, led by a disaster risk reduction team, reduces clients’ vulnerability to climate change.

Marchetti affirmed the importance of designing financial products according to what clients want. FDL has developed 30 different financial products, each one specific to clients’ needs. Marchetti sees great potential for green microlending by offering loans in combination with technical assistance to change people’s practices and make ecosystems more resilient. Successful implementation of these changes could even result in a decrease in interest rates, to reward people for changing their practices. Furthermore, green finance packages should include insurance to protect clients and microfinance institutions from natural and economic disasters.

APA has partnered with a microfinance organisation, a seed company, and a provider of agronomic services to work on a value chain proposition. Together with the partners, they are developing an integrated solution consisting of loans, weather insurance by APA, seed and fertilizer supplies, and agronomic services. In this case, the agronomic services include advice on diversification into crops that are more resilient to climate change. The partnership was crucial in enabling APA to understand the reality on the ground of their clients and develop their financial product accordingly. The partnership with the microfinance organisation, which has employees in remote areas, also helped APA improve its outreach.

Victoria confirmed the importance of partnerships. His microfinance institution, ASKI, is a group of companies with complementary services. The collaboration results in the upgrading of skills and knowledge and allows ASKI to develop holistic solutions that have a positive impact on the target communities.

Marchetti pointed out that good relationships reduce transactional costs and explained that FDL builds alliances along the whole value chain from environment to consumer. In addition, Marchetti stated that the microfinance sector can make technical assistance more efficient than donor programmes, because clients are paying for it and will push microfinance institutions to lower the price of technical assistance.

As a final recommendation, Shah emphasised the importance of integration of insurance in financial products for strengthening resilience to climate change.

Victoria stressed the need for exchange of knowledge and best practices. Marchetti concluded that the microfinance sector needs effective tools and mechanisms to measure its contribution to climate change mitigation and prove that the sector can really make a difference.