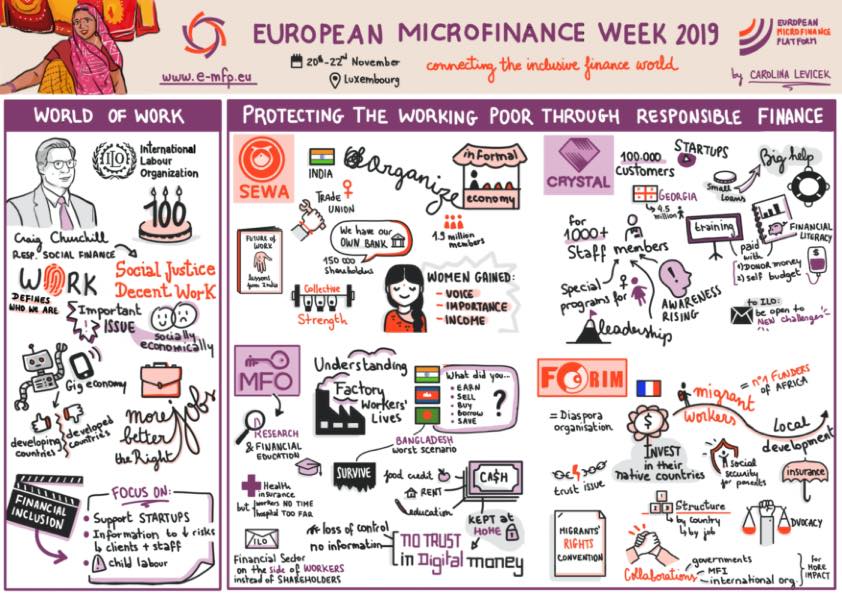

Plenary: Protecting the working poor in the 21st century through responsible finance

- Craig CHURCHILL, International Labour Organization (ILO)

- Khady SAKHO, FORIM

- Maya KOBALIA, JSC MFO Crystal (Georgia)

- Guy STUART, Microfinance Opportunities (MFO)

- Rehana RIYAWALA, SEWA (India)

PRESENTATIONS

Craig CHURCHILL of the International Labour Organization (ILO) opened the session by highlighting the importance of work, explaining that it is a crucial part of a person’s identity. As the ILO turned a 100 years in 2019, the organisation identified the future of work as a critical issue, as well as the need to re-assess the social contract between workers, employers and the state. Churchill emphasised how the financial sector has the potential to play an important role in the world of work. He illustrated this connection with three objectives: 1) More jobs; 2) Better jobs; and 3) Right(s) jobs.

Job creation has always been one of the main goals of microfinance. Churchill stressed the importance of job quality, where he believed that financial institutions can play a more active role. This follows both a moral obligation and a business logic. If an institution can enhance productivity of its borrowers, the loan portfolio would look healthier and customer loyalty would increase. Considering the rights of workers may be more challenging for financial service providers, but financial institutions (FIs) would do well to raise awareness of the issue with front line staff members, who can in turn do so with their clients. Churchill concluded that FIs have an important role to play in the world of work and that he would applaud them taking on a bigger role, by embracing a broader agenda, and serve a variety of vulnerable workers, including migrants, youth and women, as well as employees in small enterprises.

He next introduced the first panel member, Rehana RIYAWALA from SEWA which is a trade union for poor women working in the informal sector in India. Riyawala explained that the aim of SEWA is to organise women in the informal job market who in India make up 96% of this sector. She commented that collective action has other beneficial effects aside from negotiating power. SEWA supports women in gaining access to financial services, entering the mainstream economy and their inclusion in economic growth.

Riyawala explained that by organising the informal workers into unions, they enabled them to access social security from the government. In addition to working on the validity of workers’ employment contracts, SEWA also aims to improve the visibility of informal workers. She shared an example where SEWA created identity cards for construction workers, to give them a place in the community. Churchill complemented SEWA for its work, illustrating the importance of a collective approach to both gain negotiating power with the national government and to join in economic opportunities.

The next panellist, Maya KOBALIA, presented the financial inclusion organisation Crystal from Georgia. This organisation supports micro and small entrepreneurs and smallholder farmers to develop their business potential. Currently, they have 100,000 customers and around 1,200 employees and over 50 branches all around the country. The organisation started with loan provision, but quickly realised that they also needed to provide non-financial services to help their borrowers grow and develop. The loans that Crystal provides support its customers to create both higher quantity and quality of jobs.

Crystal lends to both existing businesses and start-ups. To manage the credit risk of start-up companies, Crystal focuses on building their financial literacy. Kobalia explained that these non-financial services might be costly, but at the same time they are very important in developing and growing their customers, therefore Crystal funds these services partly from the organisation’s CSR budget and partly via donor youth and women economic empowerment programs and projects. Churchill remarked that this is a common dilemma for financial institutions, wanting to reach social goals while needing to create cost-effective interventions.

Guy STUART from Microfinance Opportunities shared his experience in working with factory workers in Bangladesh, asking them to keep financial diaries. This helped to promote transparency in the garment industry, and understand the lives of factory workers, so as to engage brands, unions and policy makers. Stuart added that in order to reach transparency, financial inclusion is key. The research showed that workers in Bangladesh on average worked 20% more per month than those in India and Cambodia, for a much lower income and higher stress. Workers’ main sources of financial stress were to manage cash flow, solve food credit, save at home and to pay for health insurance.

Stuart stressed that formal low-income workers in developing countries represent a huge market. In Bangladesh alone, this group contributes USD 500 million per month to the country’s GDP. However, financial services should meet the needs of these workers, without over-indebting them. He shared results from two studies in Bangladesh on digitised wages. Focus groups on the use of digital money showed that workers cashed out their digital income. Married women reported a loss of control over their wages, as everyone could see how much they earned. Data from Business Social Responsibility showed a more favourable view, as here people also received financial education and courses on intra-household relationships. The research led to a number of important recommendations to better address the needs of this huge group of workers.

Khady SAKHO offered a perspective on another group of workers, migrant workers. As the moderator explained, FORIM is a French diaspora organisation, representing about 1,000 associations across the world. Sakho highlighted that migrants have specific financial needs, such as sending money back home and, in addition to this, they find it difficult to integrate into the workforce after they return home. Sakho explained how FORIM explores ways to help migrants, both while they’re migrating and when they return. FORIM provides returning migrants with the capital to invest in their country of origin.

Sakho explained the need to build confidence in diaspora to save and send remittances. She illustrated how microfinance institutions have an important role to play, as these are often the first point of contact. FORIM encourages migrants to save for health insurance for their families. The organisation also delivers financial education, setting up specific tools for its diaspora network. Moreover, Sakho stressed the importance of advocacy for diaspora as they are one of the leading actors in international development. FORIM works on including diaspora in decision making, on national and international levels. Churchill highlighted the economic power of diaspora, and how they contribute to development.

DISCUSSION

After discussions with the panel on working conditions for their clients and borrowers, the moderator asked how the panellists improved working conditions for their own staff. Kobalia stated that the organisation conducts social impact measurements as well as gender wage gap analyses, which helped them discover a considerable wage gap among its male and female staff. Based on the data analyses, Crystal developed female empowerment training programmes so that now women make up 50% of the Heads of the organisation’s major divisions. More than 50% of its 1,000+ staff members are female. She added that the company believes that employees are the key to represent the organisation with its 100,000+ customers at its best. Churchill commented on the work of Crystal and added the importance of labour contracts and allowing staff to organise into unions.

Churchill asked all panellists to express one wish for the ILO to work on in the next 100 years. Sakho illustrated the importance of continuous cooperation, working with partners to scale up projects. Stuart expressed the wish for the ILO to work with the financial sector on the side of the workers instead of on the side of shareholders. He requested practitioners not to stand in the way of workers to associate and form unions freely. Kobalia wished that the ILO would be open to new challenges that might be ahead in the financial sector in the next coming 100 years. Riyawala stressed the importance of focusing on the living income of informal economic workers. Churchill concluded that as financial institutions go through major changes, their employees will have different needs. He urged institutions to support its workers in building new skills and prepare them for the future of work.